Financial Planning

At Encompass Financial Planning, we are committed to helping you achieve your retirement goals, no matter where you are in the process. We do this by crafting comprehensive plans that consider all aspects of your financial situation and align with your unique needs whatever they may be as a widow, healthcare worker, or business owner, which we take time to understand in depth

Our Holistic Approach to Financial Planning

While saving, budgeting, and investing are certainly important aspects of any financial plan, our approach takes it a step further by being holistic. This means that we consider your: asset management, tax management, estate planning, and protection planning to ensure each aspect works together to form a strong, cohesive financial plan that gives you total peace of mind.

The Buck Plan® Philosophy

The old way of investing in retirement was to keep a little pile of money in the bank and the rest in a bigger pile of investments, with the intent that it would last a lifetime. However, this planning philosophy doesn’t combat the risks retirees face today or help you adequately prepare for the many costs you’ll need to cover throughout your retirement, especially soon after you retire.

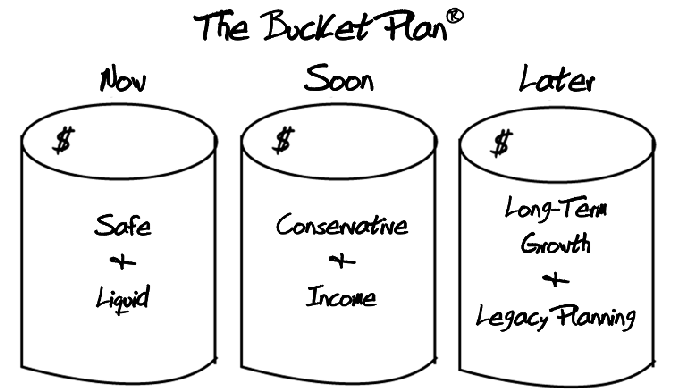

That’s why our experienced team of financial advisors utilizes a proven retirement planning process known as The Bucket Plan® to strategically allocate your assets and limit the risks you’re likely to face in retirement.

Watch this short video to see the Bucket Plan® Philosophy and planning process explained.

How Does it Work?

Being Prepared — Now, Soon, and Later

Think about the three phases we all go through during our lifetime, known as The Money Cycle: asset accumulation, preservation, and distribution. Many retirees make the mistake of jumping directly from the accumulation to the distribution stage. By never preserving a portion of your assets to draw from soon into your retirement, you run the risk of running out of money from your only source of savings, especially if the market depletes it over time. The Bucket Plan® planning approach helps prevent this mistake by segmenting a portion of your assets into three buckets, Now, Soon, and Later, based on time horizon, tolerance for market volatility, and income needs:

What’s Significant About this Comprehensive Financial Planning Approach?

Not only does The Bucket Plan® process make your retirement plan easy to understand and

follow, but it will also help mitigate retiree risks and provide peace of mind throughout your

retirement.

Holistic Financial Planning in Your Best Interest

We became fiduciary advisors because we genuinely care about the clients we serve, which

means we prioritize your financial well-being above all else. Our commitment to helping you

reach your goals is unwavering, and we achieve this by meeting you where you are and

providing comprehensive financial planning solutions tailored specifically to your needs and

aspirations.

Start Planning the Life You Deserve!

Whether you're just beginning to plan for retirement or need to refine your existing wealth

strategy, Encompass Financial Planning is here to assist you every step of the way. Our team

of Bucket Plan Certified® advisors is dedicated to helping you achieve the life you've always

dreamed of — now, soon, and later!

Let us help you get on the Encompass path to financial success. Schedule a consultation with one of our experienced financial advisors today!